Biologic drugs like Humira, Enbrel, and Remicade have changed how we treat autoimmune diseases, cancer, and chronic conditions. But they’re also some of the most expensive medicines on the market. A single dose of Humira can cost over $7,000 in the U.S., while the same drug costs less than $1,000 in Europe. Why? The answer isn’t just about research costs-it’s about biologic patent protection and how the law delays competition.

How Long Do Biologics Get Protected?

In the U.S., the law gives brand-name biologic makers 12 years of market exclusivity after FDA approval. That’s not just a patent-it’s a legal wall. For the first four years, no one can even apply to make a copy. For the next eight years, companies can submit applications, but the FDA can’t approve them. Only after 12 years can a biosimilar legally hit the market.

This isn’t how small-molecule generics work. A generic pill like metformin can be approved in as little as two years after the brand version’s patent expires. But biologics? They’re made from living cells, not chemicals. That makes them harder to copy exactly. So the FDA treats them differently. The 12-year clock starts the day the original drug gets approved-not when the patent is filed. For Humira, that means its 12-year clock started in 2002. But it didn’t face its first U.S. biosimilar until 2023, 21 years later. Why? Because of patent thickets.

The Patent Thicket Problem

Patents aren’t just one document. Companies like AbbVie pile on hundreds. For Humira alone, AbbVie filed over 160 patents covering everything from manufacturing methods to dosing schedules. Even when the core patent expired in 2016, these other patents kept competitors out. That’s called a patent thicket-legal noise designed to delay competition.

There’s also something called the “patent dance.” It’s a complicated, optional negotiation process between the brand drug maker and the biosimilar company. The biosimilar applicant must share its application and manufacturing details. The brand company then picks which patents it wants to sue over. The biosimilar responds. Then they negotiate-which often leads to lawsuits that last years. In one case, Amgen sued Sandoz over Humira biosimilars. The legal battle went all the way to the Supreme Court in 2017. These lawsuits don’t always end in a clear win. But they delay entry. And every delay means higher prices for patients.

Why the U.S. Is Behind Europe and Japan

Europe gives biologics only 10 years of data exclusivity, plus one year of market exclusivity-11 total. Japan gives 8 years of data exclusivity, then 4 more years of market protection. Both still have longer protection than generics, but shorter than the U.S.

Result? Humira got biosimilars in Europe in 2018. In the U.S.? Not until 2023. During those five years, American patients paid an extra $167 billion for biologics that were already cheaper elsewhere. The same pattern happened with Enbrel and other top-selling drugs. Patients in the U.S. are paying 300% more than patients in Europe for the same treatment.

Biosimilars Are Expensive to Make

Making a biosimilar isn’t like copying a pill. You can’t just reverse-engineer it. Biologics are made from living cells-human or animal-which means every batch is slightly different. To prove a biosimilar is safe and effective, companies must run dozens of tests: protein structure analysis, immune response studies, pharmacokinetic trials, and sometimes even full clinical trials.

Pfizer says developing a biosimilar takes 5 to 9 years and costs more than $100 million. For complex drugs like antibody-drug conjugates or gene therapies, costs can hit $250 million. Compare that to a generic pill, which costs $1-2 million and takes two years. That’s why only 38 biosimilars have been approved in the U.S. since 2015. In Europe, it’s 88.

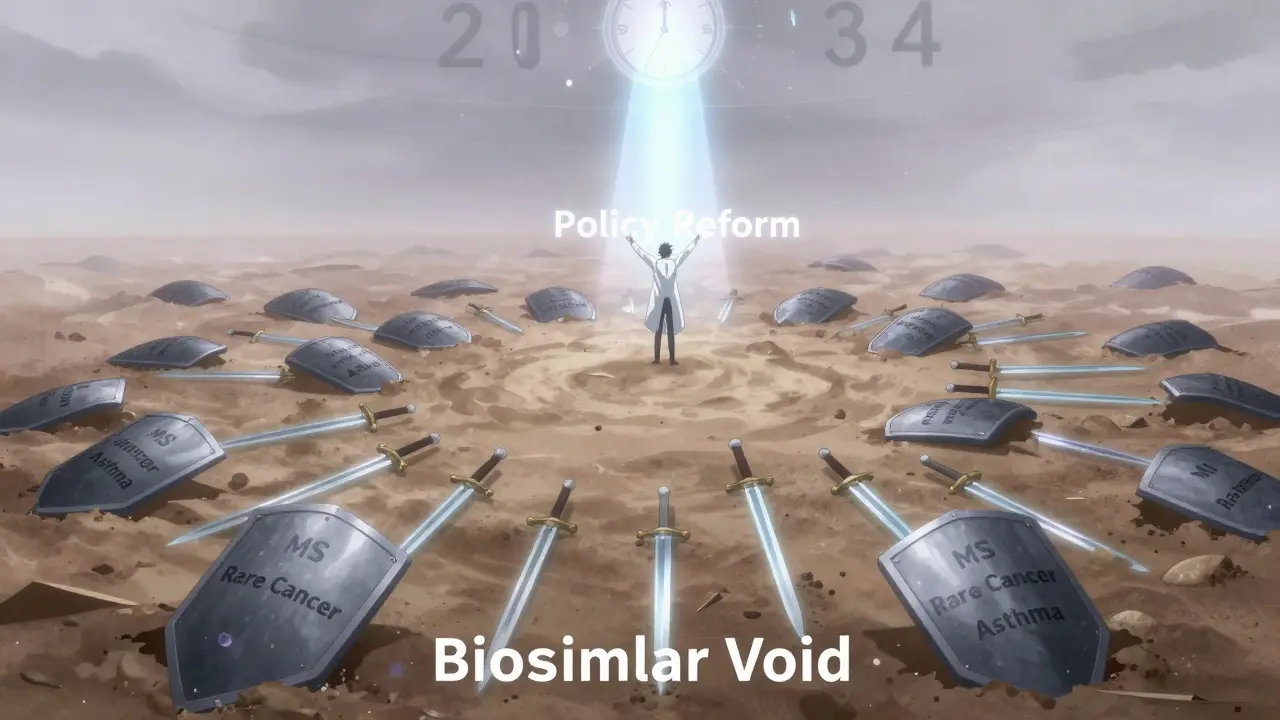

The Biosimilar Void: 118 Drugs, Few Competitors

Between 2025 and 2034, 118 biologics will lose their exclusivity. That’s a $234 billion market opportunity. But only 12 of them have biosimilars in development.

Why? Three big reasons:

- Patent timing: If a drug’s patent expires in 2027 but the exclusivity clock ends in 2029, companies wait. Why spend $100 million if you can’t sell until two years later?

- Orphan drugs: 64% of expiring biologics treat rare diseases. Small patient pools mean less profit. Only one orphan drug, eculizumab, has a biosimilar in the pipeline. 88% of orphan biologics have none.

- Complexity: Newer drugs like bispecific antibodies and cell therapies are too complicated for most companies to copy. None have biosimilars in development-even though 16 will lose protection by 2034.

This gap is called the “biosimilar void.” It’s not a glitch-it’s a system failure. Companies aren’t investing because the payoff is too uncertain. And patients are stuck paying high prices for drugs that could be cheaper.

Who’s Winning? Who’s Losing?

The big pharma companies win. They keep prices high and extend monopolies with legal tactics. The FDA wins too-they get to approve more drugs without pressure to speed things up.

Patients lose. So do insurers and employers who pay the bills. A 2022 survey by the National Community Pharmacists Association found that 63% of pharmacists had patients who stopped taking their biologic because they couldn’t afford it. People with rheumatoid arthritis, Crohn’s disease, or psoriasis are skipping doses or going without treatment.

Doctors are frustrated. Dr. Peter Bach from Memorial Sloan Kettering said the U.S. system creates a “perfect storm” for high drug prices. He pointed out that cancer patients in the U.S. pay far more for the same biologics used in Europe.

What’s Being Done?

The FDA released a Biosimilars Action Plan in 2022. It promises better communication, faster reviews, and more support for developers. But so far, little has changed. The Biosimilars User Fee Act of 2022 tried to cut red tape, but it stalled in Congress.

Some states are trying to step in. A few have passed laws allowing pharmacists to substitute biosimilars without a doctor’s permission-similar to how generics work. But federal law still blocks full substitution in many cases.

Meanwhile, the Congressional Budget Office estimates that if we fix the system, biosimilars could save the U.S. $158 billion over the next decade. Under current rules? Only $71 billion.

What Comes Next?

The next wave of expiring biologics includes drugs for rare cancers, multiple sclerosis, and severe asthma. If nothing changes, these will join Humira and Enbrel as expensive drugs with no affordable alternatives.

Real change needs three things:

- Shorter exclusivity-10 years, not 12.

- Clearer rules on patent litigation-no more patent thickets.

- Financial incentives for developers to tackle complex or orphan drugs.

Without these, the U.S. will keep falling behind. Patients will keep paying more. And the promise of biosimilars-cheaper, safer, life-changing medicines-will stay out of reach.

How long do biologics have patent protection in the U.S.?

In the U.S., biologic drugs get 12 years of market exclusivity from the date of FDA approval. During the first 4 years, no biosimilar application can be submitted. For the next 8 years, applications can be filed but not approved. The clock starts at approval, not patent filing. This is set by the Biologics Price Competition and Innovation Act (BPCIA) of 2009.

Why are biosimilars so much slower to enter the U.S. than in Europe?

Europe gives 10 years of data exclusivity plus 1 year of market exclusivity-11 total. The U.S. gives 12. But the bigger issue is patent thickets. U.S. companies file hundreds of patents to delay competition. Humira faced biosimilars in Europe in 2018 but didn’t in the U.S. until 2023. Legal battles, complex regulations, and lack of reimbursement incentives also slow U.S. entry.

Can pharmacists substitute biosimilars like they do with generics?

In most states, pharmacists can’t automatically substitute a biosimilar for the brand drug unless it’s designated as “interchangeable” by the FDA. Only a few biosimilars have that status. For most, a doctor must prescribe the biosimilar by name. This is different from generics, which are automatically substitutable in all states. The FDA has approved only 7 interchangeable biosimilars as of 2025.

Are biosimilars as safe as the original biologics?

Yes. The FDA requires biosimilars to show no clinically meaningful differences in safety, purity, and potency compared to the original drug. This means they work the same way in the body. Thousands of patients have used biosimilars in Europe and the U.S. with no new safety concerns. The approval process includes extensive lab testing and sometimes clinical trials to prove similarity.

Why aren’t more companies making biosimilars for rare diseases?

Because the market is too small. If a drug treats fewer than 200,000 people in the U.S., it’s classified as an orphan drug. Developing a biosimilar costs over $100 million. For rare diseases, companies can’t recoup that cost. As a result, 88% of expiring orphan biologics have no biosimilar in development-even though patients need affordable options.

What’s the difference between a biosimilar and a generic drug?

Generics are exact copies of small-molecule drugs made from chemicals. Biosimilars are highly similar to complex biologics made from living cells, but not identical. Because biologics are larger and more sensitive to manufacturing changes, biosimilars require more testing. Generics can be approved with bioequivalence studies. Biosimilars need structural analysis, pharmacokinetic data, and sometimes clinical trials to prove safety and effectiveness.

Donna Hammond

I’ve seen patients skip their Humira doses because they can’t afford it. One woman told me she was using half-doses to make it last longer. That’s not just expensive-it’s dangerous. Biosimilars could save lives, but the system is rigged against them.

It’s not about innovation anymore. It’s about profit. And patients are the ones paying the price.

Richard Ayres

The disparity between U.S. and European pricing is staggering. While the science behind biosimilars is sound, the regulatory and legal barriers in the U.S. create an artificial scarcity. A 12-year exclusivity period, compounded by patent thickets, undermines the very purpose of competitive markets.

It’s worth noting that the FDA’s approval standards for biosimilars are rigorous and scientifically robust. The issue isn’t safety-it’s access.

Sheldon Bird

Man, I just read this and I’m mad all over again 😤

These companies are sitting on billions while people choose between rent and their meds. It’s not capitalism-it’s cruelty. Biosimilars are ready. Let ‘em in already.

Also, 160 patents on ONE drug?! That’s not innovation, that’s legal spam.

sharon soila

Every human being deserves access to life-saving medicine. The fact that we allow corporate interests to dictate who lives and who suffers is a moral failure.

We do not need 12 years of monopoly. We need 10. We need transparency. We need justice.

Let us not forget: medicine is not a luxury. It is a right.

nina nakamura

You people act like this is a surprise. Big Pharma has been gaming the system since the 80s. The 12 year rule was written by lobbyists. Patent thickets? That’s just corporate bullying dressed up as IP law. The FDA is complicit. Congress is bought. Patients are collateral. End of story.

Hamza Laassili

U.S.A. U.S.A. U.S.A.!!! We got the best doctors, the best hospitals, the best drugs-so why are we paying 3x what Europe pays?! It’s because those lazy Europeans are just copying our stuff! We invented this stuff!! Why should we let them ride on our backs?! Also, biosimilars are probably fake and dangerous, right?? I read it on a forum!!

Rawlson King

It’s clear that the American healthcare system is structurally broken. The notion that 12 years of exclusivity is necessary to incentivize innovation is a myth. Europe manages with 11, Japan with 8, and they still produce cutting-edge therapies.

The U.S. isn’t leading-it’s lagging behind by choice. This isn’t about science. It’s about rent-seeking.

Cole Newman

Wait so you’re telling me that after 21 years, Humira finally got a biosimilar? Bro, I got a cousin with RA and she’s been begging for cheaper options since 2015. And you’re telling me the law let them hold out for 21 years? That’s not protection, that’s theft. And don’t even get me started on the patent dance-it’s a circus.

Casey Mellish

As an Aussie, I’ve seen our system work better. We get biosimilars faster, prices drop quicker, and patients aren’t bankrupted by treatment. The U.S. model isn’t ‘free market’-it’s a monopoly disguised as innovation.

Here’s the truth: if you can’t afford your medicine, the system failed you. Not you. Not your doctor. The system.

Time to fix it. Not wait for another 10 years.